The Savings Expert: Passive Income Is A Scam!

PODCAST INFORMATION

- Podcast: The Diary Of A CEO (DOAC)

- Episode: The Savings Expert: Passive Income Is A Scam! Post-Traumatic Broke Syndrome Is Controlling Millions!

- Host: Steven Bartlett

- Guest: Morgan Housel (financial expert, author of “The Psychology of Money” and “The Art of Spending Money”)

- Duration: Approximately 2 hours and 7 minutes

🎧 Listen here

📺 Watch here

HOOK

Morgan Housel dismantles the myth of passive income and reveals how our psychological relationship with money controls our happiness more than our bank balance ever could.

ONE-SENTENCE TAKEAWAY

True wealth comes not from accumulating money but from understanding the psychology behind how we spend it and aligning our financial decisions with what genuinely brings contentment to our lives.

SUMMARY

This episode features a profound conversation between Steven Bartlett and Morgan Housel, renowned financial author and expert, about the psychology of spending money. Housel challenges conventional wisdom about passive income, calling it “not a thing” and explaining that there are only two ways to build wealth: sacrifice more or want less. The discussion explores how spending is often a psychological exercise rather than a rational decision, with Housel introducing concepts like “post-traumatic broke syndrome” where people who grew up poor remain afraid to spend money even after achieving financial security.

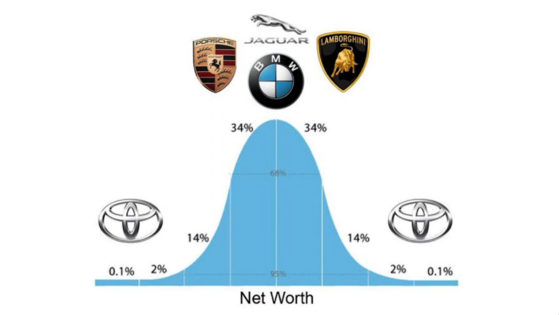

The conversation delves into the difference between status and utility in spending decisions, with Housel sharing his “deserted island” thought experiment: if no one could see what you owned, you would choose utility over status every time. He explains how social media has amplified the “arms race” of spending by making us constantly aware of what others have, inflating our definition of wealth and success.

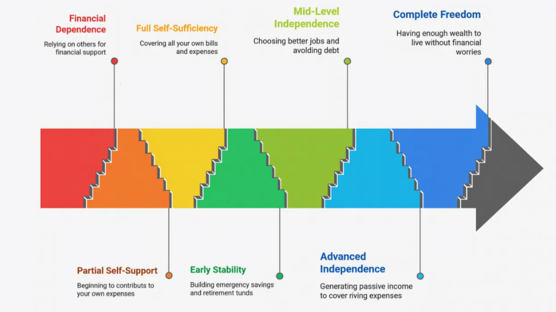

Housel presents his formula for a good life: independence plus purpose. He reframes saving not as deprivation but as “purchasing independence” every dollar saved gives you more control over your future. He introduces the spectrum of financial independence, showing that it’s not an all-or-nothing concept but exists on a continuum where even small amounts of savings increase your autonomy.

The episode explores the paradox of happiness and money, with Housel explaining that money leverages who you already are rather than changing your fundamental disposition. If you’re unhappy, more money won’t solve that; if you’re content, it can enhance your life. He shares the concept of the “arrival fallacy” the mistaken belief that reaching a certain financial milestone will bring lasting satisfaction.

The conversation touches on broader societal issues, including wealth inequality, social division, and the role of social media in amplifying polarization. Housel offers insights on how expectations shape happiness more than circumstances do, and how gratitude comes from recognizing when our current reality exceeds our past expectations.

Throughout the episode, Housel shares personal anecdotes and stories from his books, illustrating how our relationship with money often reflects deeper psychological needs and insecurities. He emphasizes that there’s no universal formula for financial happiness - each person must discover what spending patterns genuinely align with their values and bring them contentment.

INSIGHTS

Core Insights

- Passive income is largely a myth. Real income requires either sacrificing more (working harder) or wanting less (adjusting expectations)

- Post-traumatic broke syndrome affects many who grew up poor, causing them to hoard money even when they can afford to spend

- The “deserted island” thought experiment reveals that without social pressure, we prioritize utility over status in our spending

- Money leverages who you already are rather than changing your fundamental disposition

- Independence exists on a spectrum - every dollar saved increases your autonomy, even if you’re not fully financially independent

- The “arrival fallacy” explains why reaching financial milestones rarely brings lasting satisfaction

- Our expectations, not our circumstances, primarily determine our financial happiness

- Social media has amplified the “arms race” of spending by constantly exposing us to others’ lifestyles

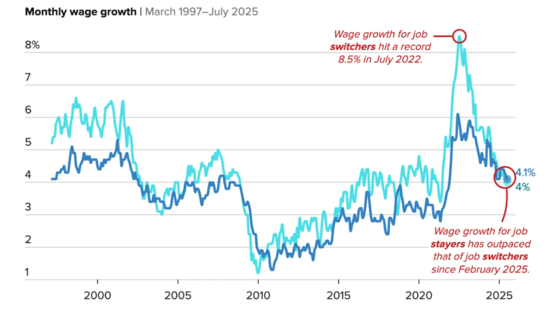

Charts

How This Connects to Broader Trends/Topics

- The wealth inequality conversation connects to broader social divisions and political polarization

- The psychology of spending relates to larger discussions about mental health and well-being

- The critique of passive income aligns with growing skepticism toward “get rich quick” schemes in financial culture

- The discussion about social media’s impact on spending connects to broader concerns about technology’s influence on behavior

- The emphasis on purpose alongside independence reflects shifting values in modern work culture

FRAMEWORKS & MODELS

The “Deserted Island” Exercise

- A mental exercise to distinguish between status-driven and utility-driven spending

- Ask yourself: “If no one could see what I owned, how would I live?”

- Reveals that without social pressure, we prioritize practical value over social signaling

- Helps identify spending decisions driven by external validation rather than genuine need

The “Reverse Obituary” Framework

- Write what you want your obituary to say about your life

- Forces clarity on what truly matters versus what society tells you should matter

- Most people focus on relationships, character, and contributions rather than material possessions

- Provides a reference point for evaluating current spending decisions against long-term values

The “Independence + Purpose” Formula

- A framework for achieving a good life, not just financial success

- Independence: The ability to do what you want, when you want, with whom you want

- Purpose: Something higher than yourself that gives meaning to your activities

- Financial independence exists on a spectrum - every dollar saved increases autonomy

- Purpose differs for everyone but is essential for true contentment

The Spectrum of Financial Independence

- Visualizes financial independence as a continuum rather than a binary state

- Ranges from complete dependence on others to complete autonomy

- Each step up the spectrum increases flexibility and reduces financial stress

- Reframes saving as “purchasing independence” rather than deprivation

The Regret Minimization Framework

- Attributed to Jeff Bezos’s decision-making process

- Project yourself to age 90 and look back on current decisions

- Ask: “Will I regret doing or not doing this?”

- Helps prioritize long-term fulfillment over short-term gratification

QUOTES

“People talk a lot about passive income. This is not a thing. Look, there’s two ways to get wealthier, and passive income is not part of that equation.” - Morgan Housel

- Context: Opening statement challenging the concept of passive income

- Significance: Sets the tone for the episode’s contrarian approach to common financial wisdom

“So much of spending is a psychological itch that you’re trying to scratch.” - Morgan Housel

- Context: Explaining the emotional drivers behind financial decisions

- Significance: Reframes spending as psychological rather than purely rational behavior

“If nobody was watching, how would I live? The truth is because virtually nobody is watching except the people who I really love and admire and they’re gonna admire me for things that have nothing to do with the kind of car that I drive or the clothes that I wear.” - Morgan Housel

- Context: Describing his “deserted island” thought experiment

- Significance: Highlights how social pressure influences our spending decisions

“I view saving as purchasing independence. That’s how I view it. I’m buying independence when I save.” - Morgan Housel

- Context: Explaining his perspective on saving money

- Significance: Reframes saving from deprivation to empowerment

“All wealth is what you have minus what you want.” - Morgan Housel

- Context: Discussing the psychological component of wealth

- Significance: Simplifies the concept of wealth to include desires, not just possessions

“Everyone is jealous of what you’ve got. Nobody’s jealous of how you got it.” - Morgan Housel (quoting Jimmy Carr)

- Context: Discussing the hidden trade-offs behind visible success

- Significance: Reminds us that we only see the outcomes, not the sacrifices

“In your 20s, people worry about what other people think of them. In your 30s, you say, I don’t care what anybody thinks of me. And in your 40s, you finally realized a truth, which was nobody was thinking about you the whole time.” - Morgan Housel (quoting Jimmy Carr)

- Context: Explaining how our concern for others’ opinions evolves with age

- Significance: Highlights the diminishing importance of external validation over time

HABITS

Practical Spending Habits

- Practice the “deserted island” exercise before major purchases to distinguish between status and utility needs

- Write a “reverse obituary” to clarify your values and align spending with what truly matters

- View saving as “purchasing independence” rather than deprivation

- Regularly assess whether your spending reflects your values or external pressures

- Practice gratitude by comparing your current situation to past expectations rather than to others’ current situations

Financial Independence Habits

- Build an emergency fund covering at least six months of expenses to increase autonomy

- Recognize that financial independence exists on a spectrum. Every dollar saved increases flexibility

- Evaluate financial decisions through the lens of independence gained rather than just return on investment

- Consider trade-offs in all financial decisions, recognizing that every choice involves opportunity costs

Mindset Habits

- Question whether your spending reflects genuine preferences or social conditioning

- Practice the “regret minimization” framework when making important financial decisions

- Cultivate awareness of the “arrival fallacy” the mistaken belief that reaching financial milestones brings lasting satisfaction

- Develop a “humble bubble” mindset where your expectations don’t extend beyond what truly matters to you

- Recognize that money leverages who you already are rather than changing your fundamental disposition

REFERENCES

- “The Psychology of Money” by Morgan Housel

- “The Art of Spending Money” by Morgan Housel

- “30 Lessons for Living” by Karl Pillemer (referenced in discussion about elderly perspectives on life regrets)

- Research on dopamine and motivation (referenced through discussion of Dr. Anna Lembke’s work)

- Tiffany Aliche’s concept of “post-traumatic broke syndrome”

- Jimmy Carr’s comedy and philosophy on social perception

- Jeff Bezos’s “regret minimization framework”

- Warren Buffett’s quote: “Success in life is when the people who you want to love you do love you”

Crepi il lupo! 🐺